All you needed to know about the Dutch income tax system but were too afraid to ask

As somebody who works in the Netherlands, you have probably already noticed a large amount of payroll tax (so-called loonheffing) listed on your salary slip. But have you ever tried to figure out how this amount is calculated? Or how this affects your total tax bill? In this article, the tax advisers at Finsens take you through the basics of the Dutch income tax system.

Income tax – general

Individuals resident in the Netherlands are liable to income tax on their worldwide income. In order to avoid double taxation, bilateral tax treaties have been concluded.

The Netherlands also has unilateral provisions that apply in general to situations where no treaty has been concluded with a particular country or where a tax treaty does not include a provision pertaining to a specific case.

In the Dutch income tax system there are three categories of taxable income, each referred to as a ‘Box’ and each having its own rate:

• Box 1 – taxable income from work and dwellings;

• Box 2 – taxable income from a substantial interest;

• Box 3 – taxable income from savings and investments.

The income tax payable is the total amount of tax on the taxable income in all three Boxes.

Box 1

The tax payable on taxable income from work and dwellings (Box 1) is as follows:

-

the first bracket: 33.45% on the first €18,218; this rate is comprised of 2.30% in tax and 31.15% in social security contributions;

-

the second bracket: 41.95% on the next €14,520; this rate is comprised of 10.80% in tax and 31.15% in social security contributions;

-

the third bracket: 42% on the next €21,629;

-

the fourth bracket: 52% on the remainder.

Box 2

Taxable income from a substantial interest in a legal entity is taxed at a flat rate of 25%.

Box 3

The tax levied on income from savings and investments is based on the assumption that a taxable yield of 4% is made on the net assets (e.g. from interest, dividends, capital gains and losses) irrespective of the actual yield. The assumed yield of 4% is taxed at a flat rate of 30%.

Taxable income from work and dwellings (Box 1)

Taxable income from work and dwellings is the total of:

-

taxable wages;

-

taxable income from an owner-occupied dwelling (interest on a mortgage loan is tax deductible);

-

taxable income from other activities (such as freelance income, payments for services and income from copyrights);

-

taxable periodical payments and grants (such as scholarships, government subsidies and subsistence allowances);

-

expenditure for income provision (such as the contributions for retirement or disability annuities; these are tax deductible).

Taxable income from a substantial interest (Box 2)

A taxpayer is regarded as having a substantial interest in a legal entity (for instance a B.V.) if he/she, either alone or together with his/her partner, directly or indirectly holds at least 5% of the shares in the legal entity.

Income from a substantial interest consists of the dividends received on such shares and the profits from the sale of shares. If a taxpayer makes assets available to a company in which he/she has a substantial interest (for example by letting premises to the company) the income generated is taxed in Box 1 as ‘income from other activities’.

Taxable income from savings and investments (Box 3)

Some examples of assets and debts that fall into Box 3 are:

- savings;

- a second home or a let property;

- shares and other securities;

- consumer loans;

- debts that do not belong in either Box 1 or Box 2.

The net assets (the fair market value of the assets after the deduction of the fair market value of the debts) are valued at the average for the calendar year and are therefore noted on two reference dates: 1 January and 31 December. In Box 3 taxpayers are entitled to a tax-free threshold of €20,661 (tax-exempt capital). If you have received dividends on your investments and dividend tax is withheld, that dividend tax can be offset against the total tax bill.

Personal allowances

Besides paying tax on the aforementioned income, you are also entitled to deduct personal allowances. The tax-deductible items of expenditure are:

-

alimony payments to an ex-partner;

-

alimony payments to children not residing at your address;

-

health care expenses that were not covered by your insurance company;

-

expenses for pursuing studies that improve your opportunities in the Dutch labour market;

-

renovation costs for an owner-occupied dwelling that is protected as a listed building;

-

renovation costs for a rented dwelling that is protected as a listed building;

-

donations to charity.

Every personal allowance has its own specific threshold, ceiling and conditions.

The total amount of deductible personal allowances is first offset against the Box 1 income. If the Box 1 income is not sufficient to deduct the total of the allowances, the remainder is offset against Box 3 income. If the latter is not sufficient either, the remainder will then be offset against Box 2 income. If at that point the total of the personal allowances has still not been fully offset, the remainder will be carried forward to the next tax year.

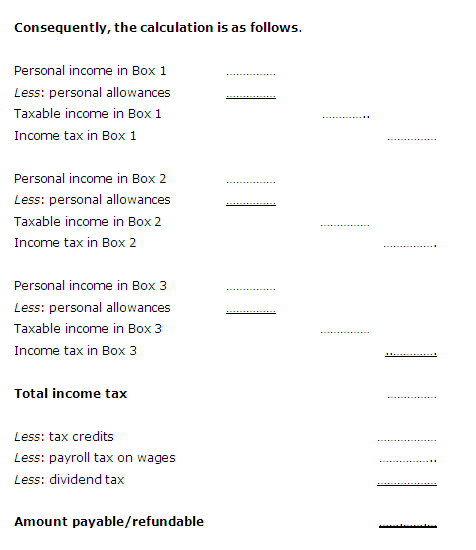

Calculating the final tax bill

The total tax bill is determined based on the income in the three Boxes and the personal allowances.

The total tax bill is reduced by deducting tax credits. There are more than 10 different tax credits, and their applicability depends on your personal circumstances. The most important ones are:

-

the general tax credit

-

the employment credit

-

the working parents' credit

The payroll tax on your wages is considered to be an advanced levy of tax and will be offset against your income tax bill.

Here is a simple calculation table for working out your taxable amount: