By John of ExpatSIPP.com

As more and more UK nationals choose to retire abroad, it’s vital to understand the pros and cons of the different options available to protect your pension.

In recent years, UK nationals have increasingly been looking beyond the UK both for employment opportunities and a place to retire.

Several million UK nationals already live overseas, and research by the Institute of Public Policy Research estimates that whilst one in twelve Britons of UK pensionable age currently live abroad, they predict that this will increase to nearly one in five by 2050.

In addition, a survey from the insurance provider RIAS found that about 10% of the UK’s over-50 population are “seriously considering” a move to another country, and data from the Office for National Statistics suggests that 400,000 people in the over-50 age group are already planning to emigrate.

What are the options if you do retire abroad?

An expat who moves abroad after working in the UK will probably have a UK pension. The UK pension system was historically designed to provide pensions to its citizens by incentivising them: by giving tax relief on contributions the person puts into the scheme. The pension pot would grow tax-free with income that is generated from the different retirement options, taxed at the person’s marginal tax rate.

If you live abroad, then you can still contribute to a UK pension, but you will only get tax relief up to £3,600 pa. Any contributions over this amount will not attract any tax relief, and you are likely to be in a pension vehicle that will tax you when you retire.

But what happens if you already have a scheme? You are probably unlikely to contribute to it once you’ve left, and it’s likely to be in a pension that is either run by an insurance company, or it’s a company-defined benefit scheme (final salary).

And it’s not entirely risk-free: we have now seen many instances where final salary pension schemes have been discontinued and a large reduction applied to the deferred pension entitlement. Public concern led to the introduction of the Pension Protection Fund in April 2006. However, it is unlikely to prove effective as increasingly more schemes wind up.

There are three options that you can consider for your UK pension scheme:

- Leave it where it is

- Transfer to a Self Invested Personal Pension (SIPP)

- Transfer to a Qualifying Recognised Overseas Pension Scheme (QROPS)

Self-Invested Personal Pension (SIPP)

- A SIPP is a UK-based pension arrangement governed by UK pension legislation.

- It is your own contract, in your own name, and you are 100% in control of its strategy.

- Capital and income can be accessed from age 55 (2010). At this time, it will be possible to provide a lump sum of 25% tax-free and, depending on where you are in the world, a tax-free income via a double taxation agreement.

- The other real advantage of the SIPP is the extent of the investment choice, meaning you can invest in a very wide range of asset types.

- SIPP costs are based on fixed amounts. The higher the amount, the lower the costs of the scheme. Most insurance-based schemes are based on a percentage value, so as the fund grows, the cost increases as well.

Qualifying Recognised Overseas Pension Scheme (QROPS)

- A QROPS is a Qualifying Recognised Overseas Pension Scheme that meets certain HMRC requirements.

- Generally, a QROPS must behave as if it were a UK pension for investors who have been UK-resident in the previous five tax years. Also, if an individual returns to the UK, the QROPS will become subject to UK pension regulations.

- However, for investors who have been non-UK-resident for at least five tax years, the QROPS becomes subject to the laws of the overseas jurisdiction in which it is based (in our case, Guernsey).

- Consequently, you can take income with no limits, and there will be no tax deduction at source, although taxation will apply in accordance with your new country of residence.

- Following death, any remaining funds can be paid as a tax-free lump sum to the nominated beneficiaries. Legislation contained in the Finance Act 2008 corrects an error in the original legislation passed in 2004.

The effect of this change is to give freedom from UK IHT on death after transferring a UK pension fund to a QROPS.

There are a number of key factors in the selection of the right QROPS:

- Where is the scheme located? We only use the Channel Islands at the moment due to the European directive on pensions. Other locations around the world have seen their status as QROPS providers removed from the HMRC list, e.g. Singapore. The result is a 55% tax on the scheme.

- How long has the scheme been around? A proven track record in administering the pensions, not only on the initial transfer but also the ongoing reporting to the HMRC and local authorities, is essential. The rules have changed over the course of the last few years, and a provider who has experience in this is invaluable.

- How much does it cost? Some of the QROPS costs are far too expensive for the amount of benefits that you receive, often running into thousands of pounds. We expect the cost to come down to SIPP levels over the next few years.

Other factors to consider

Currency

Whether transferring abroad or taking benefits from a UK scheme, consideration should be given to fluctuations in currency values – especially if the currency in the new country of residence is relatively weak or volatile.

For example, if someone is retiring abroad and the currency in the new country of residence is weak compared to the pound, it may be better not to transfer and take the benefits from the UK pension – especially if the country in question has a Double Taxation Agreement with the UK.

So, what’s the difference between a QROPS and a SIPP?

There is no real significant advantage to a QROPS over a SIPP for tax purposes before you start to take benefits.

If you remain overseas in a country that has a double taxation agreement with the UK, then it may be possible to have your pension income paid gross with no further income tax liability.

A QROPS has a better tax position after you decide to take the benefits, but before that, there is not a great deal of difference. There is however a difference in cost.

So what about the costs?

Analysis of the different QROPS providers in the market: At the moment, it is clear the biggest disadvantages are the setup and ongoing cost. The market is very similar to the SIPP market a decade ago, where the cost was high to hold a SIPP. Over time, the costs will drop to similar levels to a SIPP.

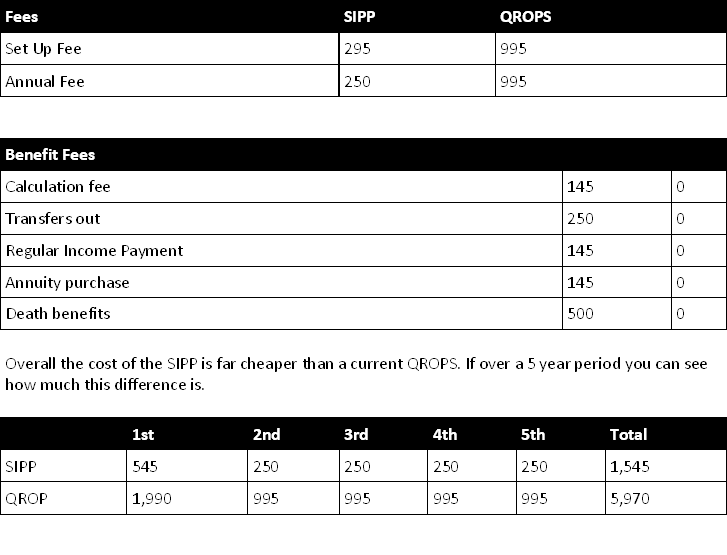

There are no real significant advantages to a QROPS over a SIPP before you start to take benefits. Therefore, given the current increased costs of setting up a QROPS, a SIPP is, in general, a more viable option. The table below shows the typical cost of a SIPP Vs QROPS.

This can add up to smaller amounts, and for the extra cost, there is no actual added benefit.

Summary

There may well be a change in future UK legislation that could add a transfer tax to move a pension out of the UK. It is unlikely that QROPS will be removed altogether, as European legislation is .in place to ensure freedom of capital movement around the EU.

Unless you are about to retire and take your pension, then a SIPP would certainly be a better alternative than a QROPS at the current time. Until the costs come down to a reasonable comparison, the option is very clear.

ExpatSIPP.com is the first independent information platform for expatriates worldwide with UK pensions. ExpatSIPP.com is not an adviser but a research platform that helps you to get more value out of your pensions by recommending the very best UK pension experts in the world today coupled with the latest news, views and trends.

To request your free Expat SIPP guide, please visit www.expatsipp.com